Ditching male defaults

In 2023 the team at Oraan, a women-led fintech startup in Pakistan, was facing lower signup rates than they expected.

Only 13 percent of women in Pakistan have a bank account, so they designed their product to be easier to use than traditional banks. Still, many women struggled to use the service, especially low-income women and first-time internet users.

What was happening? Why was it so hard to connect with customers?

The answer was always in front of them: male defaults.

The invisible made visible

Even though Oraan was built by women, for women, the startup struggled with the pervasive problem of male-centered norms.

Male defaults reflect biases deeply ingrained in our society. They allow institutions to build products to fit the way men inhabit the world: the kinds of jobs they have; how they use phones; their available free time; and even their ability to move around in public. At best, this hinders women's access to financial systems, forcing them to jump over extra hurdles. Often, it means low-income women must rely on men as proxies, having to ask a husband to save money in his bank account, and then needing his permission to access that money. At worst, it excludes women from the financial system, robbing them of opportunities entirely.

Male defaults aren't just bad for women, they're bad for business. Globally, women are 31 percent more likely to have an inactive financial account than men, and banks and fintechs wonder why. Are women just not interested in saving money? Are they not educated enough to understand new products? Are they stuck in the past? Attempts to adapt existing bank products to appeal to women have often fizzled, and many new women-centered products have tried and failed to reach product-market fit.

Why is this problem so hard to solve? It’s difficult to fix what you don’t see—and male defaults are so prevalent that they’re nearly invisible unless you know how to look for them. Anyone who has set up a bank account or used digital financial services has probably encountered them:

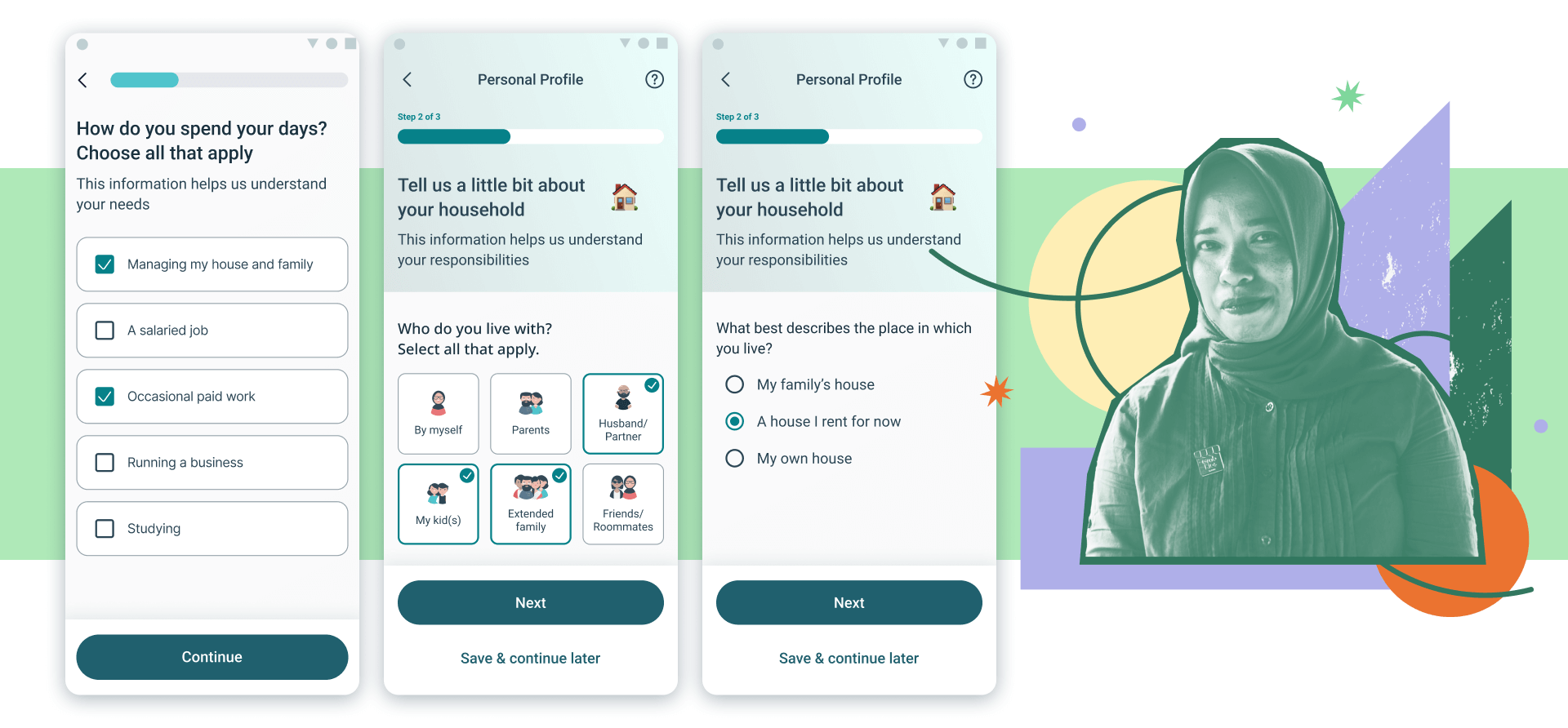

- Account sign-up processes that require customers to fill in their occupation in the first few questions (something mothers, caregivers, and the unemployed may not have, and can lead to dishonest answers)

- Marital status (which can can disadvantage or raise stigma for women who are single, separated, divorced, or widowed)

- Property ownership (which can disadvantage low-income women who rent, live with family, and women who do not have deeds or documents in their own names)

- Mobile number, especially for account verification (which can immediately cut off women who don't own a mobile phone or share one with family members)

- Annual income (which can make it very difficult for informal workers with multiple income sources to open a financial account or qualify for a loan)

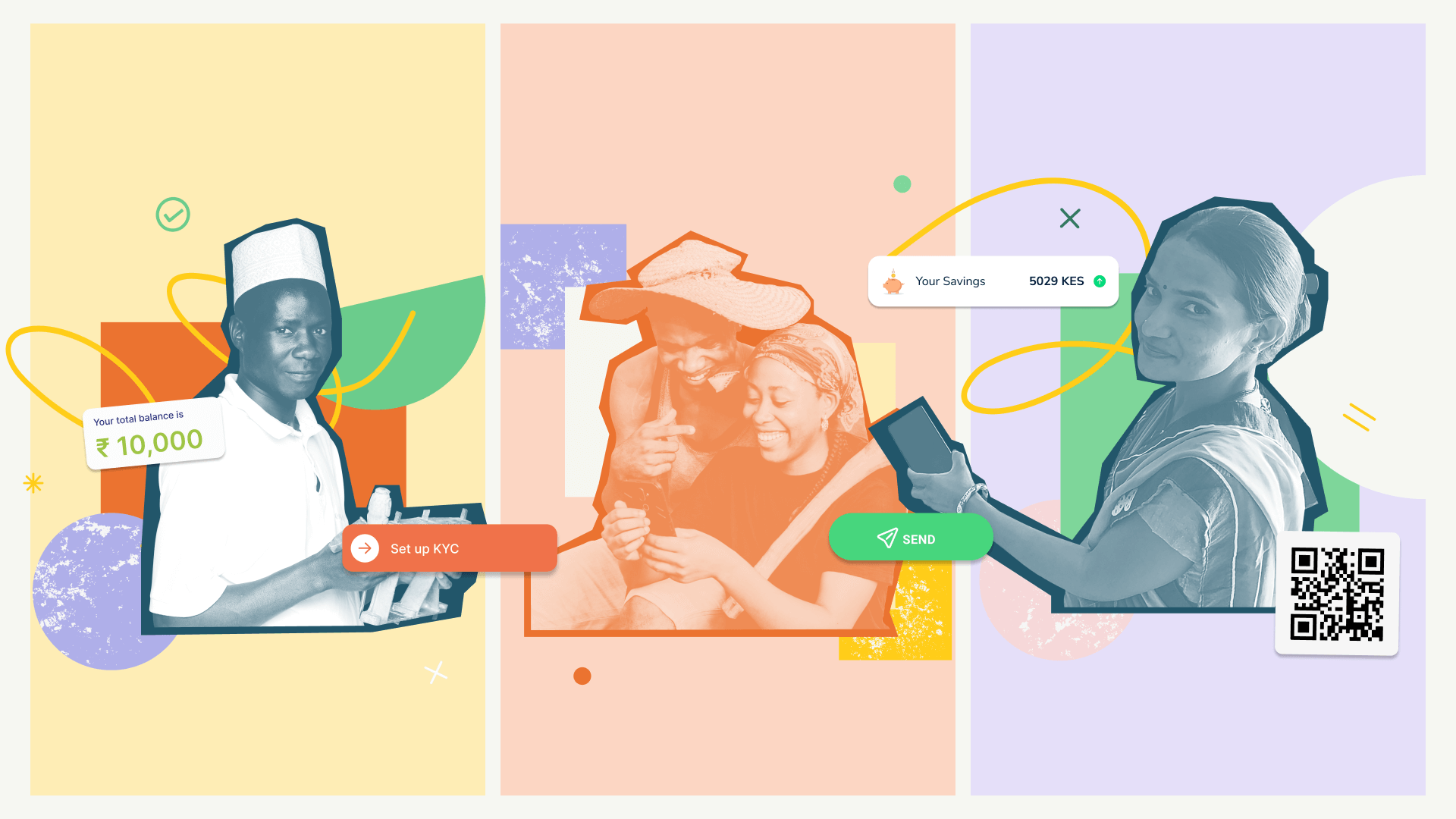

With gender-intentional design, IDEO is pushing back against these practices, and challenging the reign of male defaults. Already, we’re starting to see how even small shifts can create outsized impact for women.

An addressable opportunity

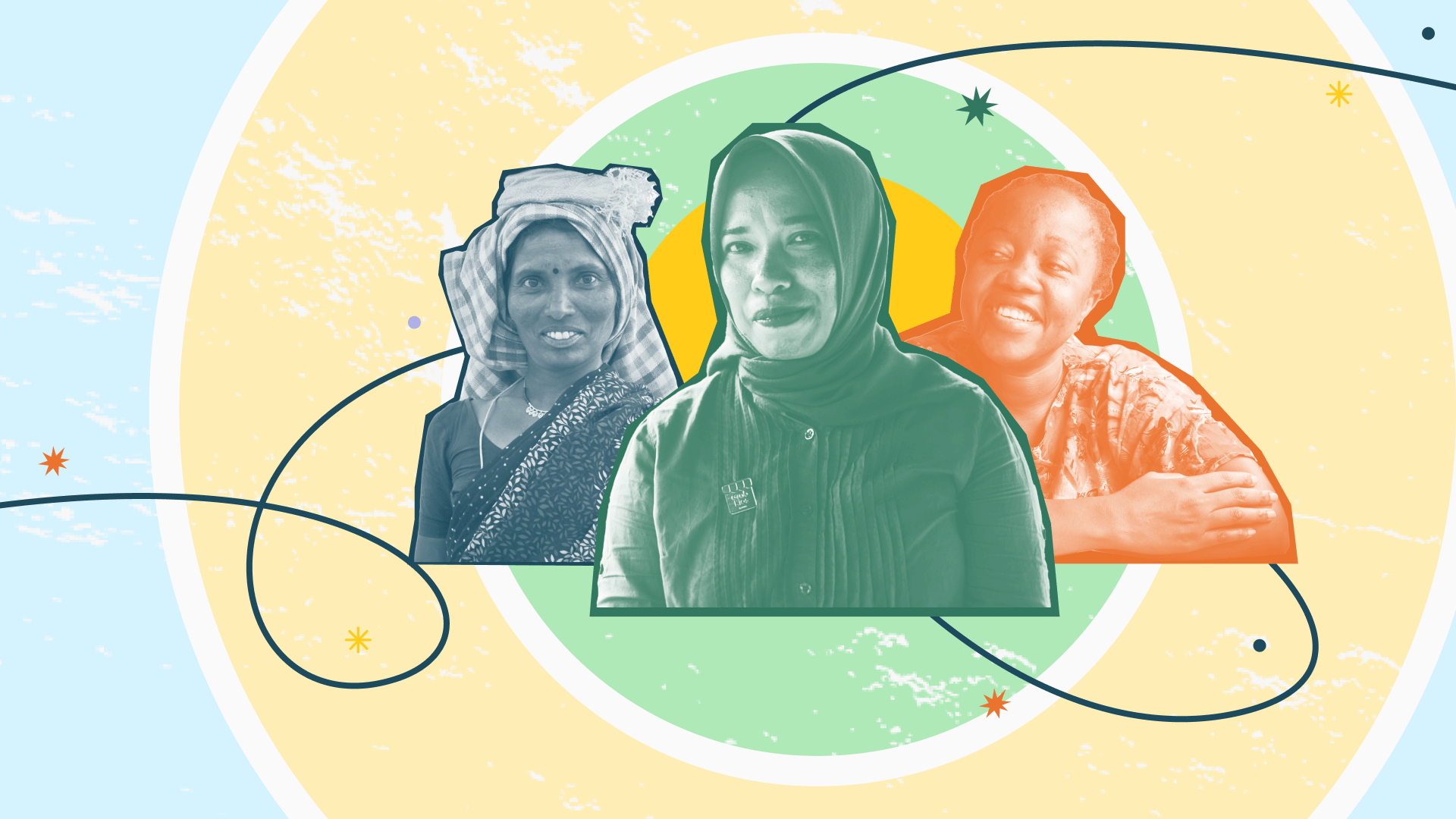

Today, more than half of the world’s 1.4 billion unbanked adults are women. At IDEO Last Mile Money, we believe the solution to filling this enormous gap in financial agency and social equity lies in better design, with products and systems made for and with women, not just adapted after the fact.

Over the last five years, we’ve brought together gender experts, banks, institutions, and fintechs to co-design what women-centric financial products should look like.

Together, we’ve uncovered male-default design patterns and developed design principles to disrupt them. We’ve updated our Financial Confidence Playbook with a new section dedicated to women and finance, with examples of products, features, and best practices for designing for underserved women. It’s all in service of helping teams question and ditch male defaults.

Here are three key shifts that can help companies build products designed for women:

1. From invasive to inclusive

If you sign up for any financial service, you’ll often see the same standard questions. While they are meant to build a user profile and increase security features, diving straight into these questions about occupation, income level, or home ownership can quickly make underserved women feel unwelcome, and push them to abandon the process altogether.

Luckily, small design changes can transform the experience. In Pakistan, we explored how to make a rigorous financial account sign-up process more inclusive. We asked Oraan: What is the information you actually need? How might we reframe data requests in ways that feel empowering for underserved women? This helped Oraan rewrite those standard questions, from “What’s your occupation?” to “How do you spend your days?” Simple, but effective: 50 percent more women signed up for Oraan’s service. And the changes also reduced the load on Oraan’s back-end systems. Because Oraan articulated its requests more clearly, women submitted higher-quality documents, which meant Oraan’s team spent less time on follow-up calls. Win-win.

2. Let’s get ‘phygital’

For women at the last mile, the journey to adopt digital finance begins long before they pick up a phone. Yet, many new products default to engaging customers via digital-only channels. So, we propose going “phygital,” connecting physical and digital experiences to meet women where they are.

Why? Many underserved women live in a world that’s mostly person-to-person and not very digital. They’re more likely to share a smartphone, and they juggle so many responsibilities as mothers, caregivers, and informal workers, they have limited time and bandwidth to try and learn new digital services.

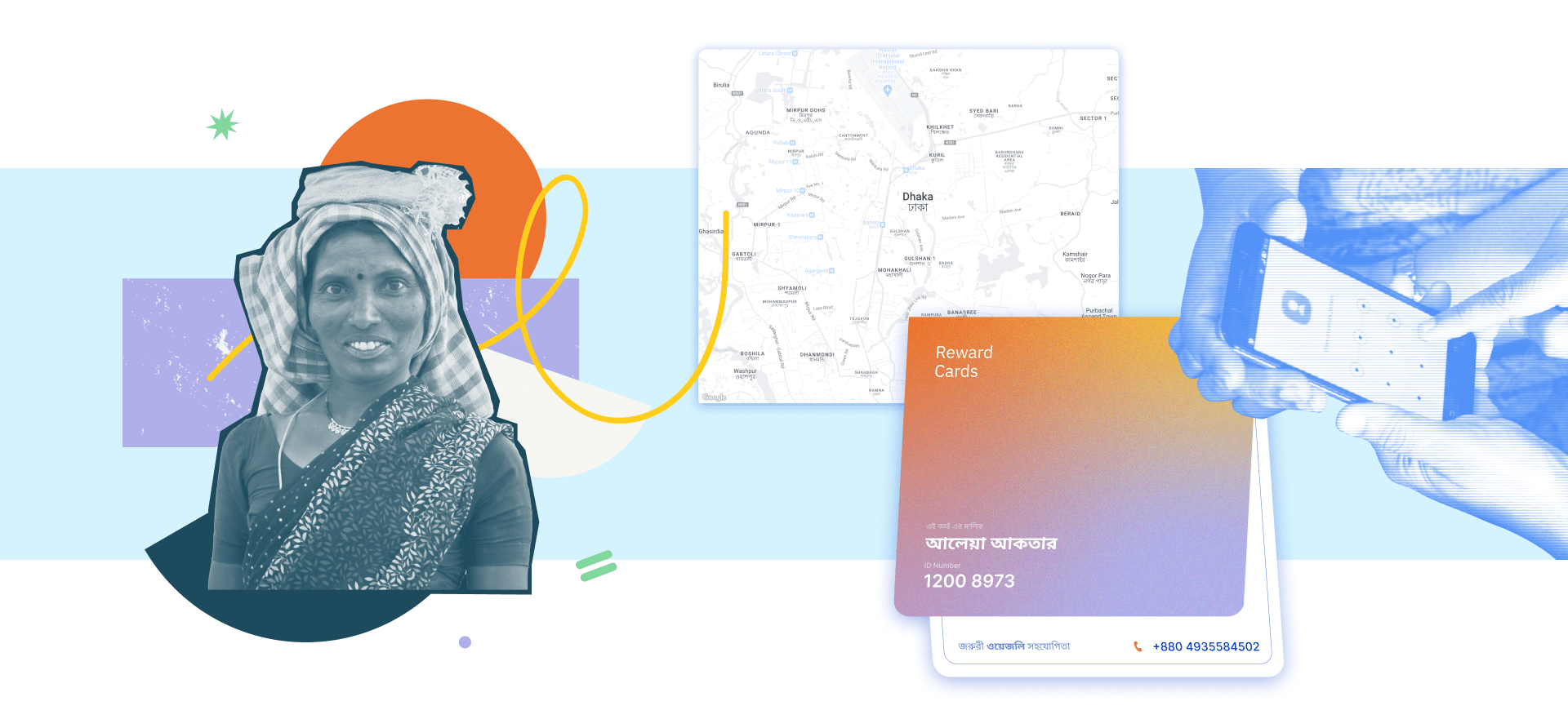

These factors affected product use at Wagely, a startup that digitizes wages for women factory workers in Asia. Many women in Bangladesh had signed up for the service, but their accounts became dormant quickly. In a country where just 21 percent of women own smartphones, Wagely needed a phygital approach.

Together we expanded its service blueprint to include a few key physical touchpoints. Our goal was to increase trust in Wagely’s service by showing up at familiar spots like community centers, building tangibility with physical collateral like membership cards, and creating a reward system that’s tailored to women’s everyday purchases like groceries and health items.

Designing for phygital might seem less cost-effective than going digital only, but it opens doors for female customers, can supercharge usage, and improves long-term retention.

3. No pink products

We believe that to truly include women in finance, their needs have to be prioritized from initial research all the way through to the future roadmap.

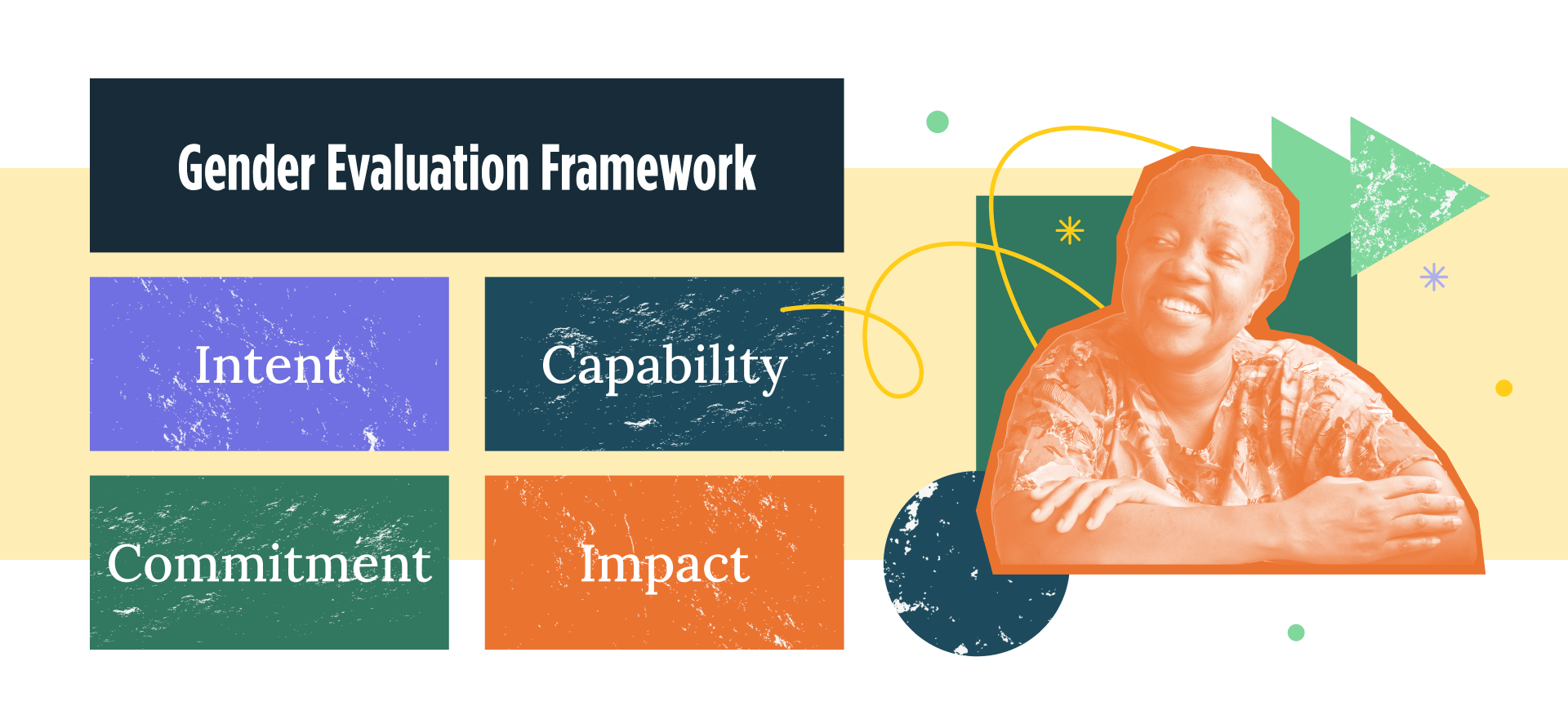

In partnership with Mansi Gupta at UnConform, a women-centric design consultancy, we created a Gender Evaluation Framework to help companies build a more gender intentional strategy that guides teams from discovery all the way to outcome measurement. With four pillars—Intent, Capability, Commitment, and Impact—teams can use our prompts to reflect on their own gender practices throughout the product cycle.

Last year, we also used the framework to choose which of the more than 300 startups that applied to Last Mile Money's 2023 gender and finance accelerator to accept. Our portfolio startups took the Framework a step further to generate insights and ideas to improve everything from product features to strategy for the future, as well as how to measure their impact on women's lives.

We’re sharing these design principles in hopes that financial institutions around the world will reconsider how they are designing their products, and include women’s needs in the process from the start—whether they’re unbanked women at the Last Mile in emerging markets, or women who have been kept out of financial systems in the U.S. Not only is it the right thing to do, it’s a way to reach the next billion women coming online.

Already, Oraan is seeing the benefits of the shift it has made to center the needs of women in Pakistan. With 50 percent more women accessing digital financial services through their platform, IDEO and Oraan are demonstrating that gender-intentional design benefits both financial providers and underserved women themselves.

Dive deeper into the Women x Finance section of the Financial Confidence Playbook.

Words and art

Subscribe

.svg)